- February 12, 2025

- Posted by: adminlin

- Category: what do i need for cash advance

Loan providers have to be hoping the household renovations can truly add worthy of https://paydayloancolorado.net/dakota-ridge/ to the home in order to accept a debtor to have so it more financial support. It means providing details about the house ree, the fresh new company otherwise team which will be doing the latest renovation, and much more.

5. Personal bank loan

Our house update fund try unsecured, which means you won’t need to promote individual guarantee to receive loans. In addition, you won’t need to have a certain amount of security of your house to be considered. Our home res to your reality-instead of putting your house at risk.

You can expect apartment prices and you can prolonged cost terminology dos,step three , so you rating inexpensively reasonable monthly payments. And money comes timely. Which have recognition within twenty four hours cuatro and you will fund on your checking account from inside the as few as 5 days 4 , you could kick off the home improvements while you are your ideas will still be new.

We customize our very own financial solutions to be right for you. Acquire as little as $20,000 otherwise around $2 hundred,000 2 -and employ your finances the right path. BHG Financial unsecured loans provide the versatility in order to:\r\letter

- \r\letter

- Replace your house \r\letter

- Combine and you will repay personal debt \r\n

- Buy the brand new potential \r\letter

- Safeguards unexpected costs \r\n

- Make significant requests \r\letter

\r\n Willing to opinion prospective loan choices? Observe how we are able to help you fund your perfect domestic home improvements quickly by going to our Commission Estimator or phone call 866-588-7910 to speak so you can financing professional today.

2 Conditions subject to borrowing from the bank acceptance abreast of achievement from an application. Loan versions, interest levels, and you will financing words will vary according to the applicant’s borrowing from the bank character. Fund matter may differ according to applicant’s condition of quarters.

step 3 Unsecured loan Payment Analogy: An effective $59,755 personal bank loan that have a beneficial seven-season name and you will an annual percentage rate away from 17.2% would want 84 monthly obligations off $1,229.

Simply utilized property res is a tiny pricier than just their finances normally coverage? Cannot worry. You’ll find several methods for you to take your suggestions to lifestyle with the help of some investment-off lending options that let you take benefit of your residence’s equity so you can signature loans that provide low monthly installments, timely funding, and large quantity.

An important was seeking a monetary provider that works for you. That is where we are in. We’ve put together helpful tips into the various ways you could funds your property improvements and also make one thing easier.

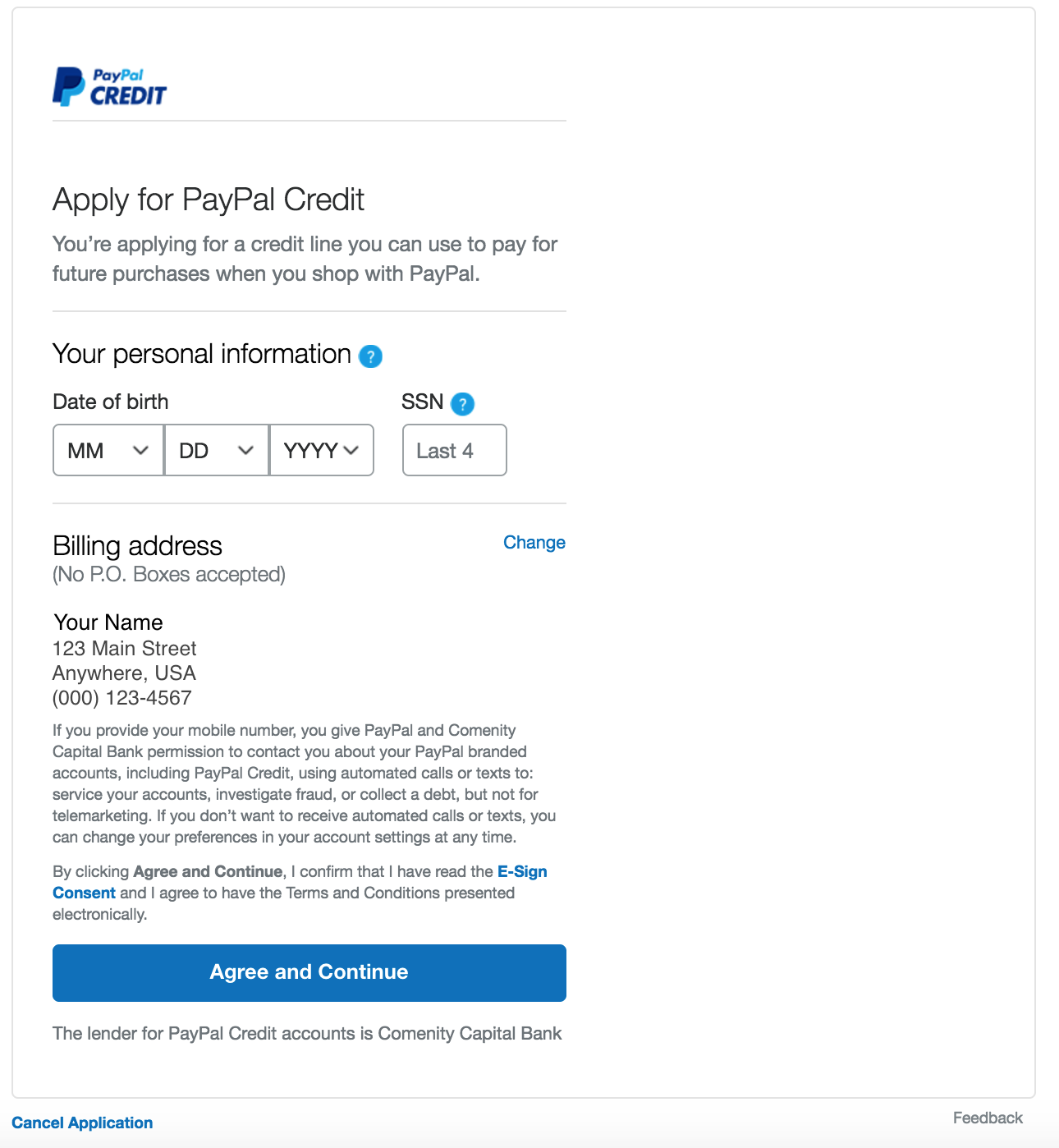

step one. Mastercard

Playing cards is actually an easy and you can smoother solution to bring your home repair ideas to lifestyle. This is particularly true to have small renovations whoever costs are smaller than just the expenses restriction.

If you don’t have a charge card-or if perhaps you are searching for you to definitely which have best pros and will be offering-now is your opportunity to apply for the proper cards and rapidly enjoy the pros.

Cards are generally an easy task to make an application for. The key would be to benefit from restricted-date introductory has the benefit of such a low Apr or 0% Apr for the balance transfers (if you’ve already covered your own renovations) and money back rewards.

On the right credit card and in the right problem, you might potentially stop paying rates of interest towards the lesser home improvements and you may score money back on each dollar you spend.

Seeking a credit card that can help you would way more? Here are a few our very own suite out of personal credit card possibilities.

dos. House collateral financing

That choice for layer household restoration will cost you will be to pull out a house guarantee loan. This is a guaranteed loan that makes use of your house’s collateral while the guarantee.

When you have enough security of your property now, you could potentially located one high sum to help you finance that otherwise several home improvement programs.