- January 12, 2025

- Posted by: adminlin

- Category: how do i get cash advance

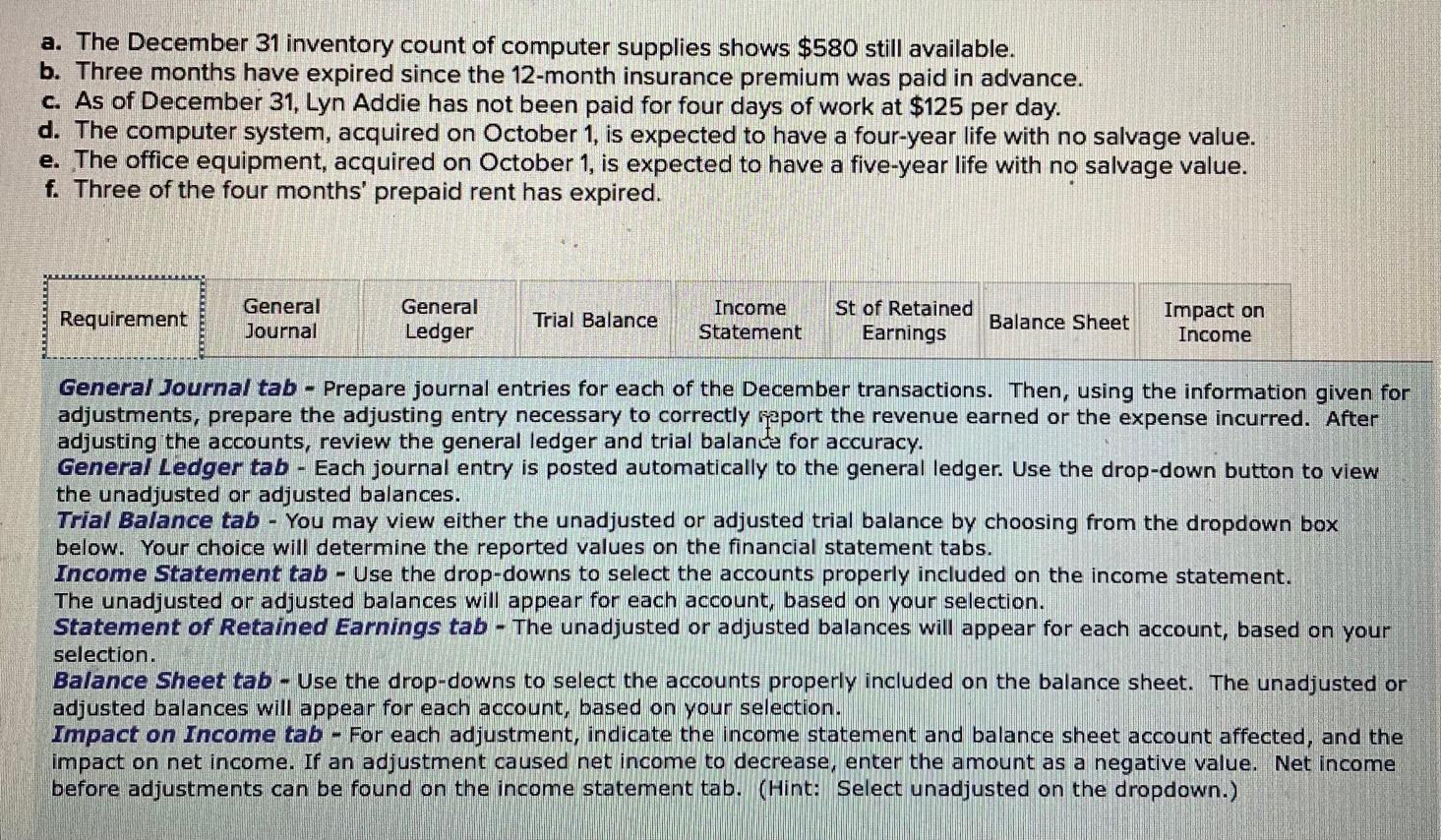

Initial element of qualifying having an effective Chattel Loan are the next information regarding the property: Make of your house, Model of Domestic, Season regarding House, How much the newest Package Book Is and get Price. Such, home created in advance of 1976 don’t meet the requirements unless of course compensating facts exist.

5. Assets Valuation

Most residential property safeguarded of the a beneficial Chattel Loan not one of them a keen assessment. Though some may, the greater number of prominent station out-of choosing the worth of a made household for the rented residential property is to utilize DataComp. DataComp brings a form of appraisal valuation you to excludes the https://speedycashloan.net/installment-loans-co/ value of your own property.

Of the talking-to a home loan expert and achieving proper believed from inside the lay, most people can perhaps work to stay a situation to help you be considered for a Chattel Mortgage.

Benefits of using an effective Chattel Financing

Among the many benefits of using a beneficial chattel mortgage so you can loans a created family towards rented land is that it will be easier to qualify for than just a traditional mortgage. It is because chattel loans, otherwise are formulated mortgage brokers, are usually in line with the worth of your house instead of your credit rating otherwise earnings.

An alternate advantage of having fun with a chattel financing is that this may feel advisable if you are planning to go the house subsequently. As the residence is thought personal possessions, it can be more straightforward to offer or flow than a property which is linked to a long-term basis.

When you’re rates try high on the an effective chattel home loan compared to a timeless financial, interest rates is actually much lower into the a good chattel financing in contrast to an individual (unsecured) loan. This will make it the lowest priced solution having capital house during the a residential district or playground with parcel costs.

Chattel Loan Disadvantages

If you are there are lots of advantageous assets to playing with an excellent chattel loan, there are also particular downsides to take on. One of the many downsides is that chattel funds normally come which have high rates of interest than antique mortgage loans. This will make loan costly in the end, especially if you decide to hold the domestic for some time big date.

A special downside of employing a beneficial chattel mortgage is that the loan title is generally reduced than a classic mortgage. As a result you will have to make highest monthly obligations within the purchase to repay the loan during the a smaller level of date. The most famous label is actually a 20 12 months otherwise a twenty-five 12 months financial.

Obtaining a beneficial Chattel Financing Washington

If you’re looking to locate a created mortgage or cellular home loan from inside the Arizona, the procedure to have obtaining an effective chattel financial is similar to one away from other says. As mentioned, step one is to try to complete a software and gives certain preliminary data to the bank.

After you have recognized the house and you can submitted the job and you may documents, the lender will start the qualification procedure. This will usually involve examining your credit history, money, and you may employment condition, and additionally performing an appraisal of the property to choose its well worth.

You to prospective advantage of obtaining good chattel loan having a created house or cellular household inside Washington is the fact that the techniques get end up being simpler than just regarding a timeless home loan. It is because reduced documents is typically expected, while the financial is generally far more ready to help you if you have reduced-than-best credit.

not, it is important to understand that chattel finance getting manufactured property otherwise cellular home go along with large interest levels and you may reduced repayment terminology than simply old-fashioned mortgage loans. As a result, it’s important to very carefully consider your choices and shop around having an educated financing terms just before committing to a produced home loan inside the Arizona and other condition.