- December 23, 2024

- Posted by: adminlin

- Category: cash advance loans near me no credit check

While you are pre-approval will bring a general concept of brand new borrower’s qualifications, conditional acceptance delves deeper toward borrower’s financial predicament and also the property’s suitability on the financing. It gives a sharper understanding of the possibilities of latest recognition and specific issues that must be fulfilled into financing to maneuver submit.

The bottom line is, conditional recognition is a significant step-in the borrowed funds application process, showing that the debtor has came across initially standards. It is unlike pre-approval, whilst relates to an even more total testing and you can set brand new stage to have last recognition and the subsequent closure process.

Conditional Approval Techniques

This calls for a comprehensive overview of this new applicant’s no credit check personal loans in Missouri financial pointers and you can paperwork to decide if they meet up with the initial standards to own a home mortgage. New conditional acceptance procedure includes one or two trick levels: documentation and you may verification, followed closely by underwriting and review.

Paperwork and Verification

During the conditional recognition techniques, loan providers want candidates to include certain files to confirm the financial standing. These data typically tend to be:

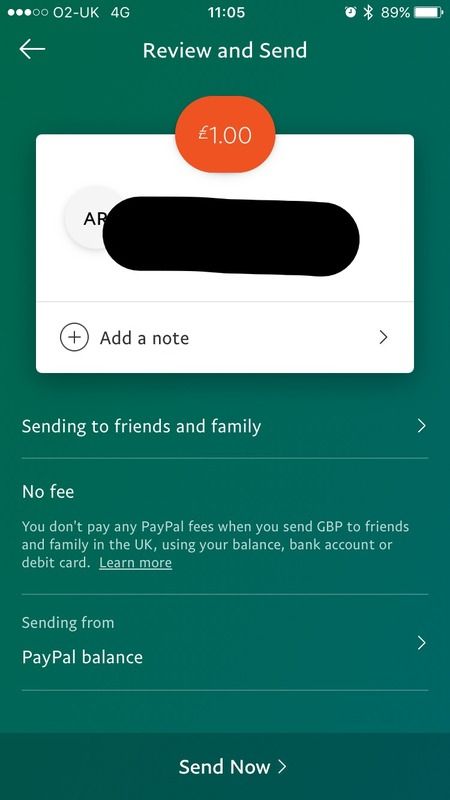

- Income Confirmation: Applicants ought to provide evidence of money, such as for example pay stubs, W-dos models, or tax statements, to display their ability to settle the borrowed funds.

- House Verification: Loan providers may consult lender statements, capital account comments, or any other documentation to ensure the newest applicant’s available possessions and you will supplies.

- A position Confirmation: Confirmation off a position means that the applicant provides a stable supply of income. This may involve calling the newest applicant’s workplace truly or obtaining a written verification.

- Debt obligations: Lenders measure the applicant’s current costs, eg charge card balances, figuratively speaking, or car and truck loans, to evaluate their debt-to-earnings ratio.

- Identity and you may Court Data files: Candidates are required to offer identification files, like a license or passport, or any other court data eg societal shelter numbers otherwise taxation identification amounts.

This type of records serve as facts so you can verify all the information offered inside the the loan software. Lenders very carefully opinion and you may make sure all the documentation to make certain precision and you can measure the applicant’s financial stability.

Underwriting and you may Review

Due to the fact expected documents try obtained and you may affirmed, the financial institution proceeds on underwriting phase. Underwriters measure the applicant’s financial reputation, creditworthiness, and the possessions by itself to decide whether or not the financing will likely be recognized.

- Credit score and you will Rating: New applicant’s credit score and you can credit rating are crucial for the determining their ability to manage financial obligation while making quick costs. A high credit history fundamentally means a lesser exposure on financial.

- Assessment and you may Property Analysis: The property’s appraised value are evaluated to make certain it matches the lender’s criteria. It testing facilitate determine the borrowed funds-to-value ratio and you can confirms that property may serve as guarantee to the mortgage.

- Debt-to-Earnings Proportion: The lender compares the fresh applicant’s month-to-month debt obligations on the gross monthly money to assess their ability to cover the borrowed funds money. A lower life expectancy financial obligation-to-earnings proportion typically ways a healthier budget.

In line with the underwriter’s investigations, the lending company get accept the mortgage with specific criteria or request even more documentation otherwise clarification. Conditional approval implies that the brand new candidate meets the first criteria getting the mortgage but nonetheless must fulfill specific criteria before last approval and you can mortgage closing.

Understanding the conditional acceptance procedure is essential having financial people. By giving exact and you can over files, applicants is also expedite the procedure and increase the possibility of obtaining final recognition due to their real estate loan.

Well-known Requirements to possess Acceptance

Whenever going through the home loan application procedure, there are some preferred problems that loan providers typically need getting acceptance. This type of conditions assist loan providers gauge the borrower’s finances and see when they qualified to receive a home loan. Listed below are around three secret requirements tend to experienced within the acceptance procedure: work and you will income confirmation, credit rating and you can score, and you can appraisal and you may possessions comparison.