- December 9, 2024

- Posted by: adminlin

- Category: can payday loans go on your credit

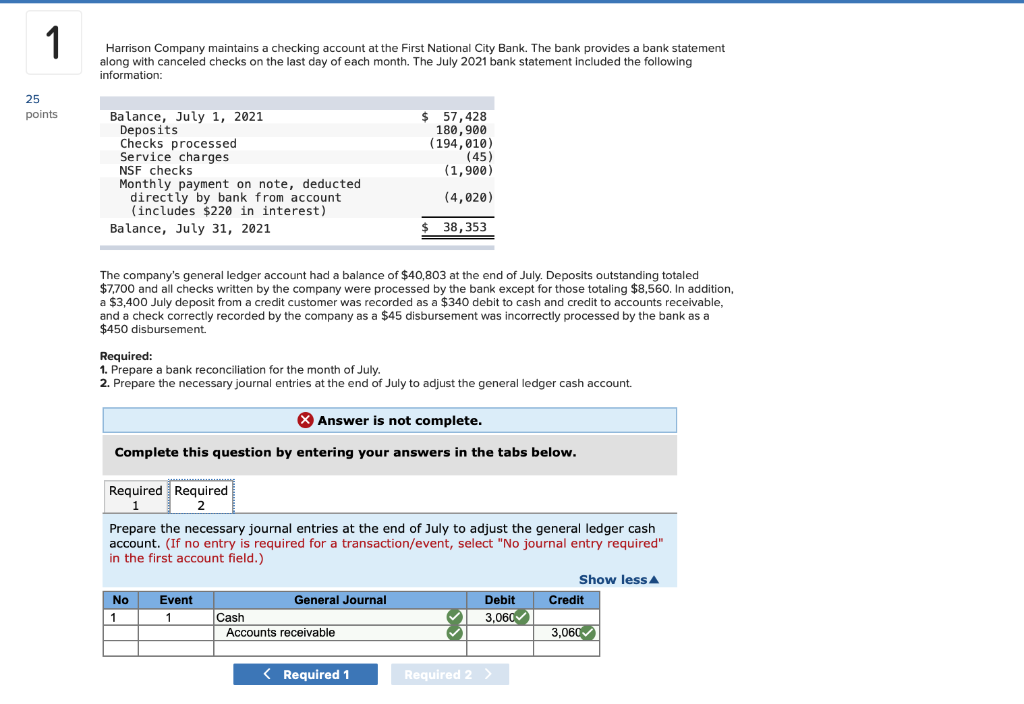

Refinancing a home loan isnt a single-size-fits-all the provider. Here you will find the crucial issue you should know whenever determining in the event the refinancing try sensible.

Your current financial situation

Start by directly examining your current financial predicament, as well as your most recent home loan terminology, rate of interest, credit history and you may financial obligation-to-income ratio. If for example the credit score has actually increased or your debt-to-earnings proportion has decreased as you initial acquired your own mortgage, you may want to be eligible for best mortgage conditions minimizing interest rates. Concurrently, take into account the balance of your money, job defense as well as how much time you intend to remain in your own house.

Your own long-title monetary wants

Select their long-identity economic objectives, and you may assess just how refinancing can help you reach all of them. For example, refinancing could well be proper whether or not it allows you to consolidate high-notice obligations, invest in renovations, otherwise save your self to have retirement. Make sure that your choice aligns along with your financial priorities and you will adds to your complete economic stability.

The expense associated with the refinancing

Refinancing can cost you may include financing origination charge, appraisal charges, term insurance and other settlement costs. In addition, it is possible to reduce certain advantages of your existing mortgage, eg prepayment benefits or rates discounts.

The vacation-also section

In the refinancing, the holiday-even area means the fresh weeks it will require on monthly deals from the the latest mortgage to counterbalance the costs associated with refinancing. In order to assess your split-actually part, divide the full refinancing costs from the month-to-month deals attained as a result of refinancing.

Guess considering refinancing your residence loan when planning on taking virtue regarding less interest rate. The newest home loan can save you $two hundred monthly on the monthly premiums. However, the expense associated with the refinancing, such mortgage origination costs, assessment fees or any other closing costs, add up to $6,000.

Contained in this example, it will require 29 weeks, or 2.five years, into coupons created by refinancing to purchase can cost you associated towards processes. In this instance, refinancing might only become a sound decision if you plan so you’re able to stay in your residence for over the vacation-also section.

However, for people who expect to move otherwise promote your property just before interacting with the break-also part, refinancing might not be the leader, since you won’t have enough time to recover the costs.

Is-it costly to re-finance?

Expensive was personal. But it’s worthy of bringing-up that refinancing your property financing can come with a selection of fees and will cost you, so that you need to comprehend the expenditures with it before making a decision.

- Release otherwise settlement fee. This might be a charge charged by your most recent bank to produce your home loan and finalise the refinancing process. Extent may differ according to the financial, it is really as large because $600.

- Software fees. The new lender can charge an application payment so you can process your own refinancing demand. This fee talks about looking at the job, carrying out a credit assessment or other administrative jobs. Software charge can range away from $0 to help you $step one,000.

- Valuation commission. Your brand-new financial might need an upgraded property valuation to decide their market price. Brand new valuation fee constantly depends on how big your house and generally range out-of $2 hundred in order to $600, however loan providers may waive it commission included in a great marketing offer.

- Mortgage subscription percentage. This is certainly a federal government payment charged to join up the latest home loan on your property identity. It payment varies from the county otherwise region but constantly falls between $100 and $2 hundred.

- Lenders Home loan Insurance (LMI). When you are refinancing more 80% of your property’s worthy of, you might $255 payday loans online same day Virginia be necessary to shell out LMI. That it insurance coverage protects the lending company in the event you standard on your financing. LMI advanced ranges from a number of thousand bucks to 10s from many, with regards to the size of the loan while the quantity of equity you really have.